Industry Vet: Rapid Change Required to Catch up to Chinese EV Maker

Caresoft Global CEO Terry Woychowski tells an audience of analysts how China’s OEMs have come so far, so quickly, a situation he said must be met with honesty about the state of U.S. and EU product development.

Terry Woychowski, CEO of engineering consultancy Caresoft Global, had a stark, sobering message for a meeting in Auburn Hills of the Society for Automotive Analysts in June that focused on how China’s government, universities, manufacturers and suppliers are aligned and focused on destroying the competition. The 47-year industry veteran was a chief engineer, program and quality manager and executive at GM and American Axle before working with Caresoft, where he has learned about the Chinese approach to vehicle development and how far ahead they are.

Woychowski's message to the U.S. auto industry is not for the easily insulted: China’s entire industry, from individual workers to boards of directors to government, are hungrier than you are, and they think you’re lazy.

Woychowski said his eyes were partially opened by a visit to the 2025 Shanghai Auto Show in May. “I would encourage you to go,” he said. “Especially if you think that driving around this area is any indication of what's happening in the auto industry.” Displayed behind him were some astounding numbers for the show:

- 1,365 vehicles exhibited, 70% of which were new.

- 163 vehicle debuts

- More than one million total visitors, including 63,000 from 97 countries and regions.

“That dwarfs the numbers of all the major North American shows combined,” he said. Woychowski said China’s national effort is incredible, citing the unofficial 9-9-6 practices in which workers toll 9 a.m. to 9 p.m., six days each week. “One way they go so fast is because they work really, really hard,” he said. “The speed at which they make decisions you could time it with a stopwatch in an industry that typically could time things with a glacier.”

Essentially, Woychowski said, China’s auto industry innovates and engineers faster, wrings out costs more quickly and gets products to market more quickly.

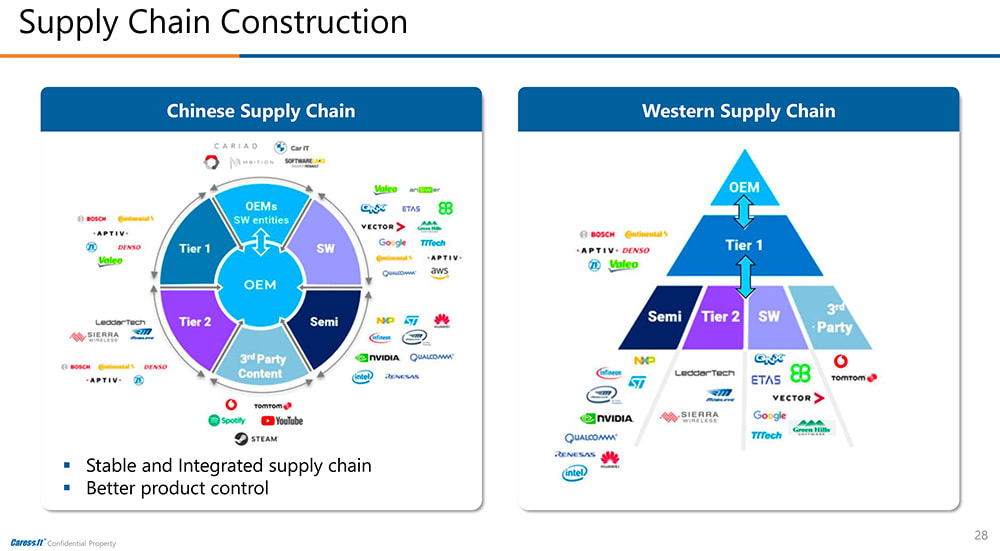

BYD and XPeng: Hurtling forward

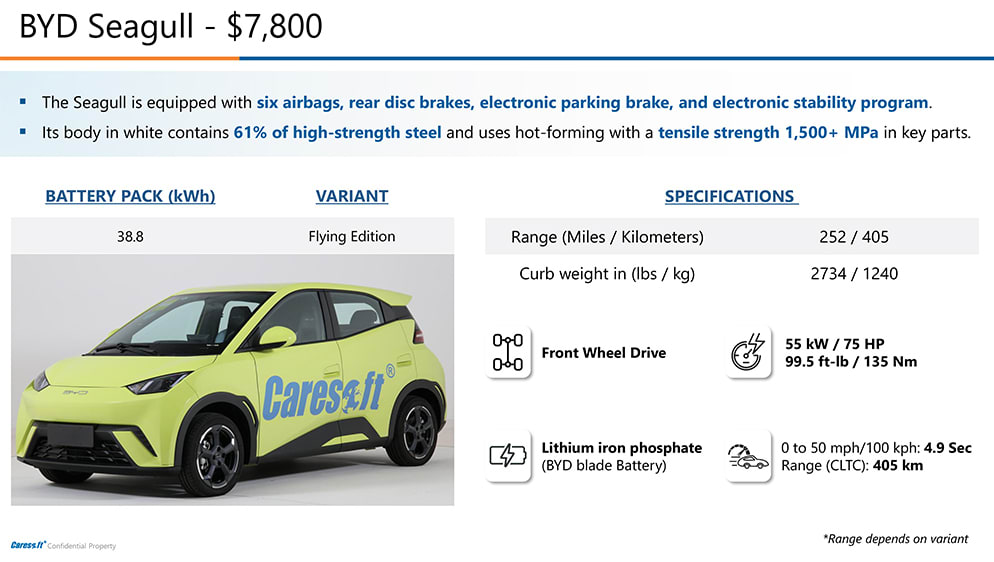

The “poster child” of China’s lead in EV product development, Woychowski said, is the BYD Seagull. The “nice, competent little vehicle” sells for about $7,800 and comes with six airbags, rear disc brakes and electronic stability. After admitting that it would need a few thousand dollars in changes to meet United States standards, Woychowski said the Seagull nonetheless brings up a question. “How can you have a $90,000 EV truck that loses money here in the United States, but they have a $10,000 EV that makes money?” He lauded BYD for its vertical integration. “We haven’t seen this since the days of Henry Ford,” he said, adding that the company employs in-house production for more than 60% of the vehicle’s bill-of-materials (BOM) cost. “The ability to go fast, the ability to not have to pay [supplier] markup and margins gives them quite an advantage.” He said that typically, in the U.S., if three automakers all wanted to buy a windshield wiper motor, they’d create the specs separately and then approach a supplier. The supplier would be happy to meet the three different sets of specifications and set each price per part appropriately. “Here they come together, simplified, streamlined, boom, and they have one for the whole industry,” he said. “So there is an alignment between the supply base and the OEMs.” He did admit that it turns supply into a low-margin business, but it’s a sacrifice they’re willing to make for competitive advantage.

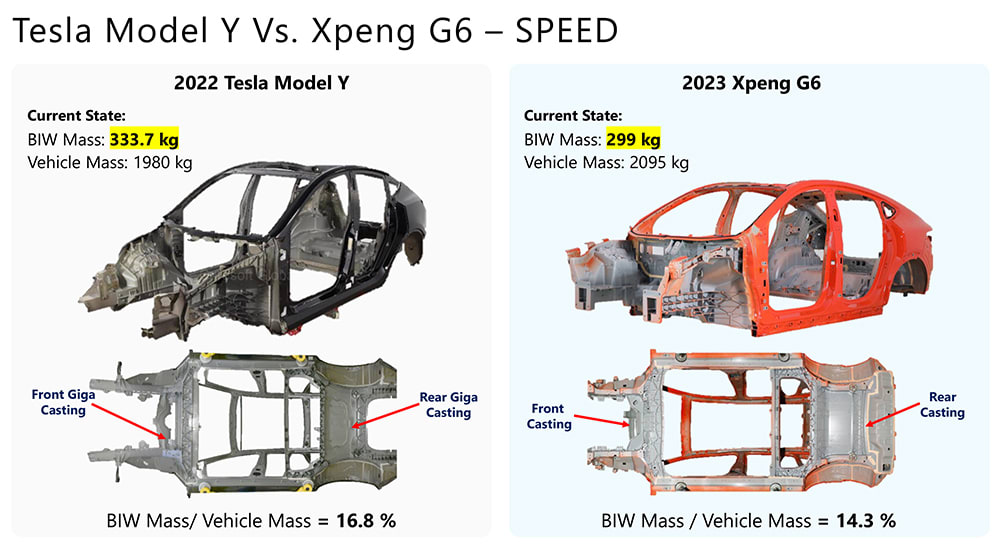

Perhaps his most stark example was that Tesla, which Woychowski and others have lauded for years for innovative production methods such as megacasting [Tesla uses the term gigacasting], is now behind China in the manufacturing process. For example, he said, the megacastings on the recently introduced XPeng G6 are lighter, less expensive and more refined than those on the current Tesla Model X.

The pace of Chinese innovation is staggering, Woychowski said, citing a BYD executive who told him the company files for 45 patents every day. “I’m proud to say I filed for two in my career,” he said. Traditional OEMs: Willful blindness? Woychowski said U.S. and EU executives are willfully blind to what is happening around them. He cited the number of executives who argue that any of Tesla’s models are not their competition. “We have a product in the market,” he said the U.S. execs would say, “and we benchmark them, we drive them, we experience them and out of 10 vehicles, it ranks 10 out of 10. We really don’t even pay any attention to it.” “Here’s the problem,” Woychowski said. “[Tesla had] the number one selling EV and the number one selling model period. So explain to me how… you don’t consider it a competitor? The hell is wrong with you?” He said nearly every vehicle produced in America is internally judged by the same criteria, such as max lateral Gs, NVH, fit and finish. And EVs are “already too fast for the average driver, and you want them going faster.” “Maybe you’re focusing on something the customer isn’t,” he said.

Change efforts must go faster

Though he repeatedly stressed the urgency required of American and EU manufacturing change efforts, he did try to leave the audience of analysts, engineers and journalists on an optimistic note, saying “I’m very confident we can do it, but we have work to do.”

“The only strategic advantage you can have at the end of the day is speed. We can buy more steel. We can buy more aluminum. We can get more copper. I can get more money. I can get more people,” he said. “I can’t get one more minute. And when that minute comes and it goes, it's dead.”

“Remember, it’s not the big that eat the small. It’s the fast who eat the slow.”

Top Stories

INSIDERManufacturing & Prototyping

![]() How Airbus is Using w-DED to 3D Print Larger Titanium Airplane Parts

How Airbus is Using w-DED to 3D Print Larger Titanium Airplane Parts

INSIDERManned Systems

![]() FAA to Replace Aging Network of Ground-Based Radars

FAA to Replace Aging Network of Ground-Based Radars

NewsTransportation

![]() CES 2026: Bosch is Ready to Bring AI to Your (Likely ICE-powered) Vehicle

CES 2026: Bosch is Ready to Bring AI to Your (Likely ICE-powered) Vehicle

NewsSoftware

![]() Accelerating Down the Road to Autonomy

Accelerating Down the Road to Autonomy

EditorialDesign

![]() DarkSky One Wants to Make the World a Darker Place

DarkSky One Wants to Make the World a Darker Place

INSIDERMaterials

![]() Can This Self-Healing Composite Make Airplane and Spacecraft Components Last...

Can This Self-Healing Composite Make Airplane and Spacecraft Components Last...

Webcasts

Defense

![]() How Sift's Unified Observability Platform Accelerates Drone Innovation

How Sift's Unified Observability Platform Accelerates Drone Innovation

Automotive

![]() E/E Architecture Redefined: Building Smarter, Safer, and Scalable...

E/E Architecture Redefined: Building Smarter, Safer, and Scalable...

Power

![]() Hydrogen Engines Are Heating Up for Heavy Duty

Hydrogen Engines Are Heating Up for Heavy Duty

Electronics & Computers

![]() Advantages of Smart Power Distribution Unit Design for Automotive...

Advantages of Smart Power Distribution Unit Design for Automotive...

Unmanned Systems

![]() Quiet, Please: NVH Improvement Opportunities in the Early Design...

Quiet, Please: NVH Improvement Opportunities in the Early Design...