US Companies Advance DoD Investment in Rare Earth Materials Supply Chain

Since 2020, the Department of Defense (DoD) has invested $400 million into U.S.-based companies to expand the domestic supply chain for rare earth materials needed to manufacture the permanent magnets used in important U.S. military weapons systems. Over the next year, manufacturing facilities at several companies that received that funding will have the machinery, tools and equipment necessary to convert those refined materials into metals and then magnets.

"DoD's recently published National Defense Industrial Strategy will guide the creation of a modernized defense industrial ecosystem," said Laura Taylor-Kale, Assistant Secretary of Defense for Industrial Base Policy. Taylor-Kale has a doctorate in management science and engineering with a specialization in organizations, technology and entrepreneurship from Stanford University's School of Engineering.

"Resilient supply chains are essential to this goal. The U.S. can no longer afford to rely on overseas, single-points-of-failure for critical components," Taylor-Kale added.

Rare earth permanent magnets are not only essential components in a range of defense capabilities, including the F-35 Lightning II aircraft, Virginia and Columbia class submarines and unmanned aerial vehicles, but also a critical part of commercial applications in the United States. They are also used to generate electricity for electronic systems in aircraft and focus microwave energy in radar systems.

In total, DoD has awarded more than $439 million over the last four years to establish domestic rare earth element supply chains. This includes separating and refining rare earth elements mined in the U.S., as well as developing downstream stateside processes needed to convert those refined materials into metals and then magnets.

"DoD's strategic investments are building capability at multiple stages of the rare earth supply chain and will provide a clear signal to private capital that the time is right to build additional resiliency," said Danielle Miller, Acting Deputy Assistant Secretary of Defense for Industrial Base Resilience. "We are on track to meet our goal of a sustainable, mine-to-magnet supply chain capable of supporting all U.S. defense requirements by 2027."

In addition to the F-35, Virginia and Columbia class submarines, magnets produced from rare earth elements are used in systems such as Tomahawk missiles, a variety of radar systems, Predator unmanned aerial vehicles, and the Joint Direct Attack Munition series of smart bombs. The F-35, for instance, requires more than 900 pounds of rare earth elements. Each Arleigh Burke DDG-51 destroyer requires 5,200 pounds, and a Virginia class submarine needs 9,200 pounds.

Rare earth elements are also used in other ways that don't involve magnets. Vehicle-mounted laser range finders, such as those found on Abrams M1A1/2 tanks, make use of rare earth elements, as do their portable counterparts and target designators. Also making use of rare earth elements are; fiber optics communication systems; cerium-polished optical lenses; and sonic transducers used in submarine sonar systems.

There are 17 elements on the periodic table referred to as "rare earth" elements. While DoD needs nearly all of them in some capacity, three are used to make the permanent magnets critical to so many defense systems.

Continued U.S. reliance on foreign sources for rare earth products poses a risk to national security. The U.S. and most of the world depends on China for many rare earth elements.

Through the Office of the Assistant Secretary of Defense for Industrial Base Policy, the Manufacturing Capability Expansion and Investment Program directorate has embarked on a five-year rare earth investment strategy to build "mine-to-magnet" domestic capacity at all critical nodes of the rare earth supply chain. Those critical nodes include sourcing, separation, processing, metallization, alloying and magnet manufacturing.

The first of those critical nodes, the sourcing of rare earth elements, means mining rare earth elements out of the ground. Today in the U.S., there is only one rare earth mine currently active and selling to the commercial market.

Separation includes a series of processes that take out extractable rare earth elements from other elements and compounds in the mineral rock. Processing involves concentrating separated rare earth elements and then chemically treating them to produce high-purity rare earth oxides or rare earth salts. The metallization step transforms rare earth salts into rare earth metals. Depending on the application, those metals can be combined with various alloying elements to produce a variety of rare earth alloys.

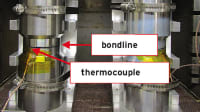

Rare earth magnets are typically produced from alloys that are sintered, or bonded, into magnet block and then cut and coated according to specification. The Defense Department is trying to ensure that all those critical nodes happen inside the U.S. to establish a secure supply of the rare earth materials and rare earth magnets it needs to manufacture new weapons and technology.

Projects underway have already helped the U.S. establish growing capacity in rare earth element separation and processing, as well as magnet manufacturing.

Among the U.S.-based companies involved in DoD's "mine-to-magnets" initiative is MP Materials, which is headquartered in Nevada. With $45 million in support from MCEIP awards, MP Materials established the only integrated rare earth mine and oxide production facility in the U.S. The company is expected to continue to add capacity for additional oxide products through 2025, when they are projected to reach full-scale production.

Right now, domestic and partner demand for rare earth materials outpaces the production of any single partner nation. To build resiliency in these critical, early stages of the supply chain, Lynas USA, LLC was awarded a combined $288 million in MCEIP funding to establish a second domestic, commercial-scale oxide production capability by 2026.

MCEIP has also invested $10 million to explore the development of extraction technology and alternative sources of rare earth minerals from coal ash, acid mine drainage and other waste streams.

Noveon Magnetics has established a rare earth magnet manufacturing facility in San Marcos, Texas, with a $28.8 million award from MCEIP. The company produces qualified magnets from extracted or recycled material for both defense and commercial applications.

An additional award of $2.3 million from MCEIP has also helped TDA Magnetics to demonstrate a capability to source, produce and sell qualified magnets into DoD supply chains.

Finally, with a $94.1 million award, E-VAC Magnetics will establish a commercial-scale rare earth magnet manufacturing capability by 2025. As part of this project, E-VAC will also develop domestic capacity to produce rare earth metals and alloys, a critical node of the supply chain linking early-stage rare earth processing to magnet production.

Future MCEIP investments are expected to focus on closing remaining supply chain gaps and promoting integration among the tiers.

Top Stories

NewsRF & Microwave Electronics

![]() Microvision Aquires Luminar, Plans Relationship Restoration, Multi-industry Push

Microvision Aquires Luminar, Plans Relationship Restoration, Multi-industry Push

INSIDERAerospace

![]() A Next Generation Helmet System for Navy Pilots

A Next Generation Helmet System for Navy Pilots

INSIDERDesign

![]() New Raytheon and Lockheed Martin Agreements Expand Missile Defense Production

New Raytheon and Lockheed Martin Agreements Expand Missile Defense Production

INSIDERMaterials

![]() How Airbus is Using w-DED to 3D Print Larger Titanium Airplane Parts

How Airbus is Using w-DED to 3D Print Larger Titanium Airplane Parts

NewsPower

![]() Ford Announces 48-Volt Architecture for Future Electric Truck

Ford Announces 48-Volt Architecture for Future Electric Truck

ArticlesAR/AI

Webcasts

Electronics & Computers

![]() Cooling a New Generation of Aerospace and Defense Embedded...

Cooling a New Generation of Aerospace and Defense Embedded...

Automotive

![]() Battery Abuse Testing: Pushing to Failure

Battery Abuse Testing: Pushing to Failure

Power

![]() A FREE Two-Day Event Dedicated to Connected Mobility

A FREE Two-Day Event Dedicated to Connected Mobility

Unmanned Systems

![]() Quiet, Please: NVH Improvement Opportunities in the Early Design Cycle

Quiet, Please: NVH Improvement Opportunities in the Early Design Cycle

Automotive

![]() Advantages of Smart Power Distribution Unit Design for Automotive &...

Advantages of Smart Power Distribution Unit Design for Automotive &...

Energy

![]() Sesame Solar's Nanogrid Tech Promises Major Gains in Drone Endurance

Sesame Solar's Nanogrid Tech Promises Major Gains in Drone Endurance