Porsche Study: Europe Missing out on Tooling Battery Gigafactories

Study shows European engineering firms severely lag China in potential to supply manufacturing tooling for future battery factories.

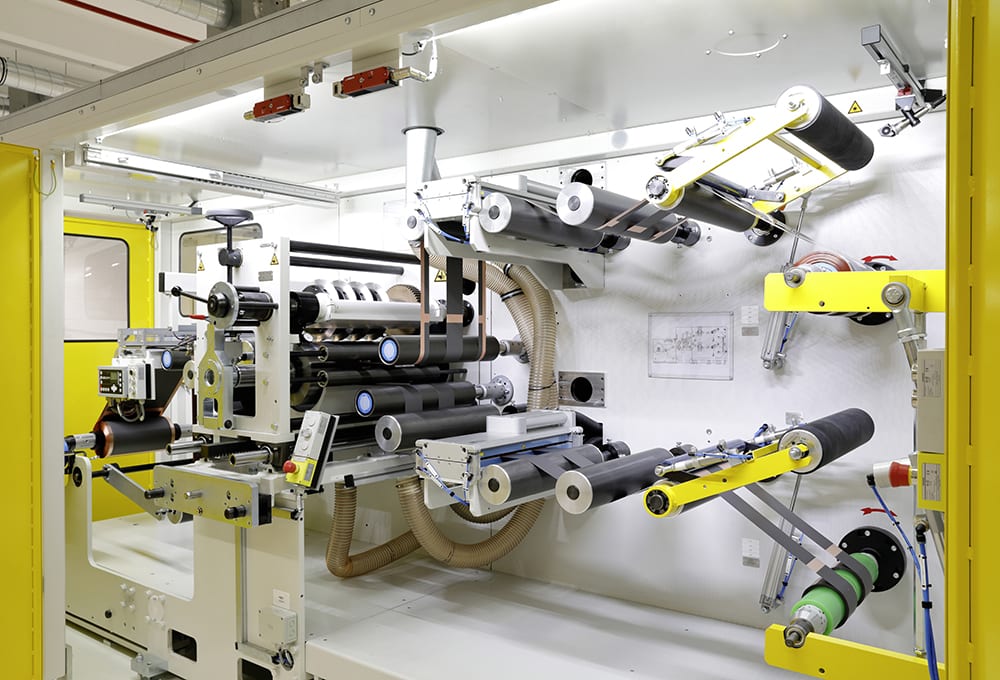

A study examining the prospects for supplying manufacturing tooling for the scores of EV battery “gigafactories” scheduled to be built worldwide found there are opportunities for Europe-based mechanical and production-engineering firms. But it also serves as a warning that China-based engineering companies have established deep foundations in the vertical integration typical of gigafactory construction – foundations that may prove difficult to shake.

The study, “Battery Manufacturing 2030: Collaborating at Warp Speed,” was conducted by Porsche Consulting in collaboration with the German Mechanical Engineering Assn. (VDMA). It determined that, worldwide, there are approximately 200 EV battery gigafactories either planned or currently under construction. “At the moment,” the study blunted concluded, those battery manufacturing facilities “are mainly equipped with production technology from Asia. Chinese machine builders are currently setting the standard as full-service providers. Only eight percent of the high-tech equipment in such factories comes from Europe.”

In a release, the VDMA said it represents more than 3,600 German and European companies in the mechanical and plant-engineering sectors, companies that employ approximately three million people in the European union, including more than 1.2 million in Germany. The study warned that Europe’s 8% share of the market for battery-factory equipment “is too low to have a significant influence on technical development and to create a second cluster for battery technology that is based in Europe. This would require a permanent market share of about 20 percent.”

The study’s analysis indicated that collaborations such be a focus of the European plant-tooling industries. “Only if European mechanical engineering firms succeed in jointly offering integrated factory solutions will they be able to hold their own against the competition from Asia,” said Gregor Grandl, Senior Partner at Porsche Consulting and co-author of the study. “Technologically, European industry is on an equal footing,” he continued, “but companies from China are already offering turnkey battery plants.”

“Customers’ exacting requirements for turnkey suppliers require a rethinking in the ramp-up phases for this industry,” said Stephan Eirich, President of Maschinenfabrik Gustav Eirich GmbH. “This poses new challenges even for experienced machine and plant engineering firms, but we’re up to the task.”

The study said the market for machinery and plant manufacturers in the battery sector alone is 300 billion euros between now and 2030. To maintain Europe’s current market share 8% during this period of rapid gigafactory construction, the study determined a growth rate of 33% per year would be necessary – and to attain a 20% market share, companies would have to grow faster than the market. “Success in this competitive environment would secure Europe permanent access to the important future technology of batteries and create many jobs in the process,” the report indicated.

The study can be downloaded here .

Top Stories

NewsSensors/Data Acquisition

![]() Microvision Aquires Luminar, Plans Relationship Restoration, Multi-industry Push

Microvision Aquires Luminar, Plans Relationship Restoration, Multi-industry Push

INSIDERRF & Microwave Electronics

![]() A Next Generation Helmet System for Navy Pilots

A Next Generation Helmet System for Navy Pilots

INSIDERWeapons Systems

![]() New Raytheon and Lockheed Martin Agreements Expand Missile Defense Production

New Raytheon and Lockheed Martin Agreements Expand Missile Defense Production

NewsAutomotive

![]() Ford Announces 48-Volt Architecture for Future Electric Truck

Ford Announces 48-Volt Architecture for Future Electric Truck

INSIDERAerospace

![]() Active Strake System Cuts Cruise Drag, Boosts Flight Efficiency

Active Strake System Cuts Cruise Drag, Boosts Flight Efficiency

ArticlesTransportation

Webcasts

Aerospace

![]() Cooling a New Generation of Aerospace and Defense Embedded...

Cooling a New Generation of Aerospace and Defense Embedded...

Energy

![]() Battery Abuse Testing: Pushing to Failure

Battery Abuse Testing: Pushing to Failure

Power

![]() A FREE Two-Day Event Dedicated to Connected Mobility

A FREE Two-Day Event Dedicated to Connected Mobility

Automotive

![]() Quiet, Please: NVH Improvement Opportunities in the Early Design Cycle

Quiet, Please: NVH Improvement Opportunities in the Early Design Cycle

Electronics & Computers

![]() Advantages of Smart Power Distribution Unit Design for Automotive &...

Advantages of Smart Power Distribution Unit Design for Automotive &...

Unmanned Systems

![]() Sesame Solar's Nanogrid Tech Promises Major Gains in Drone Endurance

Sesame Solar's Nanogrid Tech Promises Major Gains in Drone Endurance